Tax Season Tips for Small Businesses and Freelancers

Tax season is often dreaded by small businesses and freelancers, but it doesn’t have to be! With the right preparation and planning, tax season can be a breeze. Let’s dive into some tips and tricks on how to make the process just a little bit easier.

Gather your paperwork

The first step in preparing for tax season is gathering your paperwork. This includes financial documents such as bank statements, receipts, invoices, payroll records, etc. Gather all of these together in one place so that you won’t have to scramble at the last minute trying to track everything down.

Determine your business structure and file the appropriate paperwork

Choosing the right structure from the get-go can make a huge difference when tax season rolls around. This includes understanding which type of entity best suits your needs (such as sole proprietorships, partnerships, limited liability companies, or corporations). Additionally, it is important to take advantage of any write-offs you may be eligible for; these can significantly reduce your annual tax burden, so don’t forget them!

Calculate your income and expenses

Once you have your paperwork gathered, it’s time to calculate your income and expenses for the year. This will help you figure out what deductions are available to you, which can potentially save you money come tax time!

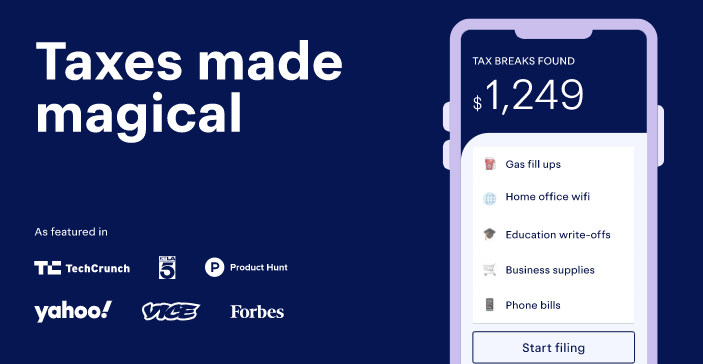

💡ELE Tip: Team ELE is enthusiastic about Keeper, an incredible smart tax software for entrepreneurs, freelancers, 1099 independent contractors, and other self-employed people. Keeper makes it super simple to identify purchase write-offs and deductions. This intuitive system allows contractors operating under a 1099 to reduce and minimize taxes in a totally legal manner. Learn more about it here.

Get organized

Start a folder or spreadsheet to keep track of your documents throughout the year so that tax season isn't just one big scramble session at the end of the year. Having everything organized in one place will make things infinitely easier when it comes time to file your taxes.

Make a plan for next year

When this year's taxes are filed away, take some time to think about what changes you can make now so that next year won't be such a headache. What systems or processes can you set up now so that collecting documents and tracking expenses isn't such an arduous task?

Seek help when needed

Finally, if filing taxes feels overwhelming, don’t hesitate to seek help! There are plenty of resources available online (like Keeper!) that specifically cater to contractors, freelancers, and small businesses looking for help with filing their taxes correctly and efficiently.

Tax season doesn't have to be overwhelming if taken one step at a time! As long as proper preparation is done ahead of time, filing taxes should not cause too much stress or hassle come April 15th!

Follow us on social media, where you can see more tips, best practices, and industry updates!